DCAL: Strong Development Base, Elusive Commercial Payoff

Probability of Clinical Trial Success by Phase

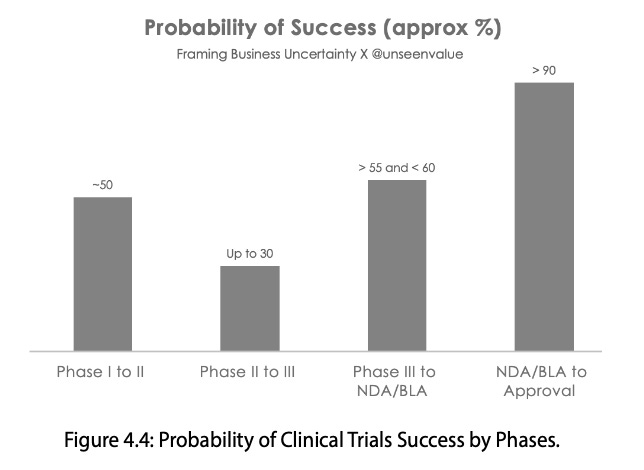

Figure 4.4, titled "Probability of Clinical Trial Success by Phases" in my book (Framing Business Uncertainty), visualises the approximate probability of success across key stages of drug discovery and development. It appears in Chapter 4 of the book, which outlines the principle, “Fail Frequently and Fail Early”.

The figure underscores the immense uncertainty and high likelihood of failure inherent in the innovative life sciences pipeline.

Key insights from Figure 4.4 and its context

1. Low overall likelihood of approval (LOA)

The data illustrates that most experimental drugs do not successfully advance from Phase I to full regulatory approval and commercial launch. Between 2011 and 2020, the overall likelihood of approval (LOA) from Phase I was estimated at only 7.9 per cent.

For Novel Chemical Entities (NMEs), the odds were even lower—around 5.7 per cent. In other words, only about 8 per cent of novel compounds entering Phase I ever reach the market.

2. Phase II as the biggest hurdle

Phase II represents the toughest stage of development, often called the “valley of death”. The figure indicates that only 28.9 per cent of candidates successfully move through this stage, making it the single largest attrition point in the process. Average success rates here typically remain below 30 per cent.

3. Improved odds in later stages

Once a molecule progresses into Phase III, the probability of success rises considerably—averaging around 57 per cent across therapeutic classes. Although uncertainty never disappears entirely, outcomes at this stage become relatively more predictable and manageable.

4. Success as a tail event

The data reinforces the idea that drug development success follows a “tail-event” pattern—rare, unpredictable, yet transformational when it occurs. Each success belongs to what I call the “extremistan passport”.

A molecule beginning at the pre‑clinical stage can take 10 to 15 years to reach approval. The overwhelming frequency of early failures, combined with the low probability of a breakthrough, defines the entire risk‑reward profile of the industry.

Frequent small failures in early stages limit downside exposure, while a rare, late‑stage success delivers extraordinary upside—an asymmetric payoff that validates the “Fail Frequently and Fail Early” philosophy.

With that refresher, it’s time to turn the spotlight on Dishman Carbogen Amcis (DCAL), which has lagged the CDMO leaders from Divis Labs to Neuland Labs. Divis and DCAL had a very comparable MCap in 2004, and at that time Neuland Labs was just about 15% of the MCap of DCAL (in other words, DCAL was 6 times bigger in MCap).

My current view on DCAL

Keep reading with a 7-day free trial

Subscribe to Antifragile Thinking to keep reading this post and get 7 days of free access to the full post archives.