Framing the Context

Great businesses with strong earnings, solid management, and positive sentiment almost never come cheap. Top-quality companies rarely trade at bargain prices when strong trailing earnings meet positive sentiment to create a carnival atmosphere. Seth Klarman sums it up perfectly: when everyone’s optimistic, prices stay elevated. In short, truly great stocks rarely show up at dirt-cheap valuations.

Invert. Always invert!

Now, taking all of this into account, I see a sector currently in deep depression. Earnings are down, multiples have collapsed, and market sentiment is bleak. Historically, this combination of depressed earnings coupled with low valuations and negative sentiment has been a powerful setup for me across sectors and cycles.

So, am I spotting a rare “right place, right time” moment in an overlooked sector? This isn’t about the usual suspects like precision engineering in defence and aerospace, life sciences or semiconductors. I watch those pockets closely, but finding a multi-domain precision engineering play with strong cash flows and low valuations amidst broader sector hype is extremely rare.

Last week, I got lucky stumbling on exactly that opportunity, and I shared the details here. When markets get shaky and sentiment tanks, that’s often when bargain prices pop up—it’s a classic mix of crowd psychology and market quirks. But ironically, most investors miss these setups for the same reasons they happen.

Why uncertain, volatile times create bargains?

Sentiment swings like a pendulum. Markets tend to swing wildly between hype and panic. When everyone’s gloomy, stocks often get sold off way below what they’re really worth—a case of “reflexive or system 1 induced selling” without much thought, as the Nobel Prize-winning psychologist and a founding father of behavioural finance, the great late Daniel Kahneman, explained in his seminal book, Thinking, Fast and Slow (2011).

Emotions run the show. Fear and greed go into overdrive during uncertainty. Bad news, whether company-specific or macro issues like politics or interest rates, triggers overreactions and deep price drops that don’t match the company’s long-term fundamentals.

Price and value diverge. Value investors focus on terminal or intrinsic value—the true worth beneath the noise. When sentiment plunges, market prices stray far below terminal value, creating what Buffett calls a “margin of safety.” He sees uncertainty as a buyer’s friend because it makes prices dirt cheap and risky assets become less risky.

Short-term myopia. The market often ignores great long-term prospects because investors are stuck on short-term results. The classic case of 90% market attention on something that’s not even 10% of the terminal value. Probable good outcomes get discounted heavily just because they don’t show up in the next quarter or two.

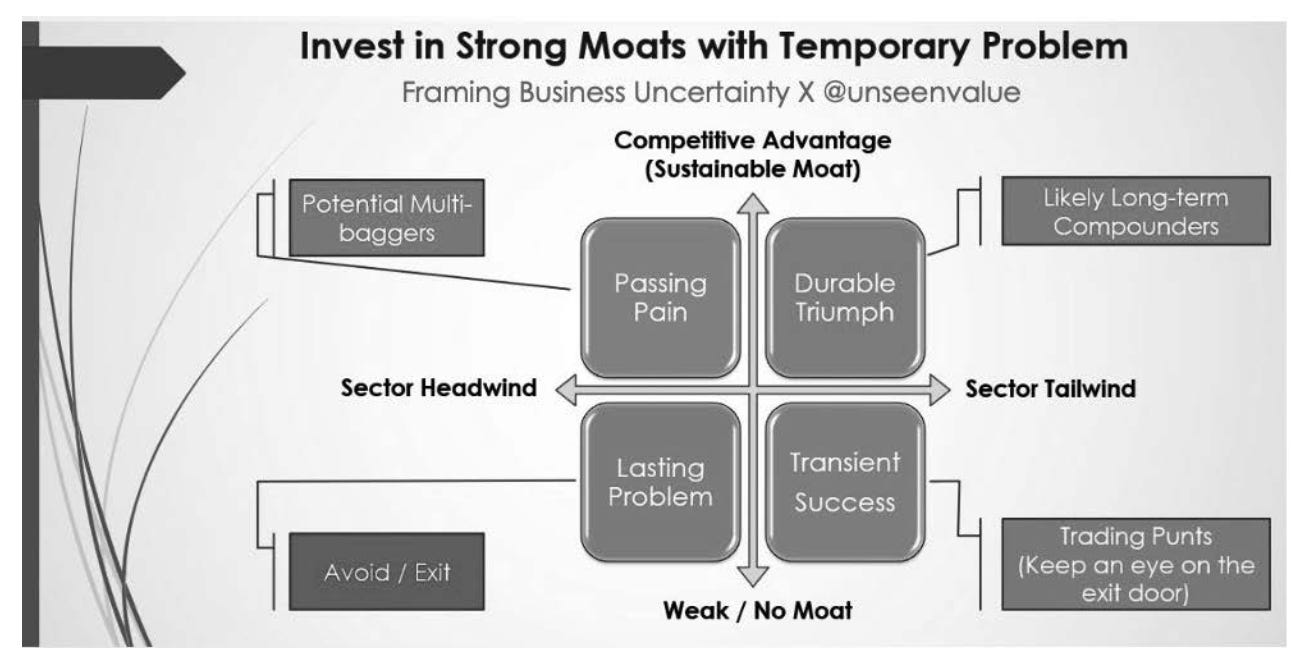

Cyclicality and temporary headaches. Many businesses go through cycles. Sometimes a company looks cheap because of temporary storms, not hurricanes. Smart investors separate transient problems (aka ‘passing pain’) from lasting disasters and spot real opportunities in the chaos.

Source: Framing Business Uncertainty

Why investors miss out?

Loss aversion and fear. People hate losses way more than they enjoy gains. This makes investors shy away from stocks showing any trouble, even if those stocks are bargains. The fear that comes with falling prices often makes folks sell at the worst moments instead of buying.

Herd mentality. Nobody wants to be the odd one out or look foolish. When everyone panics and sells, individual investors find it hard to go against the crowd—even if that’s where the money is. It’s safer socially and professionally to follow the pack. After all, social acceptance is often a primary objective.

Short-term performance pressure. Institutional investors and fund managers often get judged on short-term results—sometimes every few months. This forces them to avoid stocks that might underperform next quarter even if they look great over several years. Playing it safe helps protect jobs but kills long-term gains.

Overconfidence and illusion of control. Investors often believe they can predict and control outcomes better than reality allows. This leads to underestimating risks and digging patterns where none exist, which can cause nasty surprises.

Recency bias. We all overweight recent events too much. After a tough patch, investors chase last cycle’s winners—which are often overpriced—instead of hunting fresh bargains.

Risk complexity. As Nassim Taleb explains, markets don’t follow neat patterns or normal distributions. Big shocks happen more often than models expect, and many investors struggle to factor in uncertainty vs. risk properly. This makes gauging true value and downside risks tricky.

Kidding yourself and lack of discipline. John Maynard Keynes nailed it—too many focus on guessing market mood (speculation) instead of long-term returns (long-term goals). Sticking to a disciplined value approach means standing your ground when everyone else is running, which is psychologically tough but pays off.

Battling Headwinds: Bird's Eye View of this Story

Keep reading with a 7-day free trial

Subscribe to Antifragile Thinking to keep reading this post and get 7 days of free access to the full post archives.